Maximum Contribution To 529 Plan 2024

Maximum Contribution To 529 Plan 2024. What’s the contribution limit for 529 plans in 2024? One of the many benefits of 529 plans is there is no federal limit on the amount.

Annual contributions over $18,000 must be reported to the irs. What is a 529 savings plan?

Maximum Contribution To 529 Plan 2024 Images References :

Source: www.elementforex.com

Source: www.elementforex.com

529 Plan Contribution Limits For 2023 And 2024 Forex Systems, Good news, while there is a maximum aggregate 529 plan contribution limit, there is no annual 529 plan contribution.

:max_bytes(150000):strip_icc()/529-plan-contribution-limits-2016.asp_Final-28fe6ce80ec7400fb9e62e35624d8c2b.jpg) Source: lichaymarina.pages.dev

Source: lichaymarina.pages.dev

Max Contribution To 529 In 2024 Liane Brandise, Be aware that there is a maximum amount of $35,000, as a lifetime limit, that can be rolled from a 529 plan to a roth ira.

Source: tobiqcissiee.pages.dev

Source: tobiqcissiee.pages.dev

Nys 529 Max Contribution 2024 Coreen Tuesday, The states with the highest allowed aggregate 529 contribution limits include:

Source: ehsaasprogramonline.com.pk

Source: ehsaasprogramonline.com.pk

2024 529 Contribution Limits Your Ultimate Guide to Max Contributions, What’s the contribution limit for 529 plans in 2024?

Source: www.youtube.com

Source: www.youtube.com

529 Plan Contribution Limits Rise In 2023 YouTube, One of the many benefits of 529 plans is there is no federal limit on the amount.

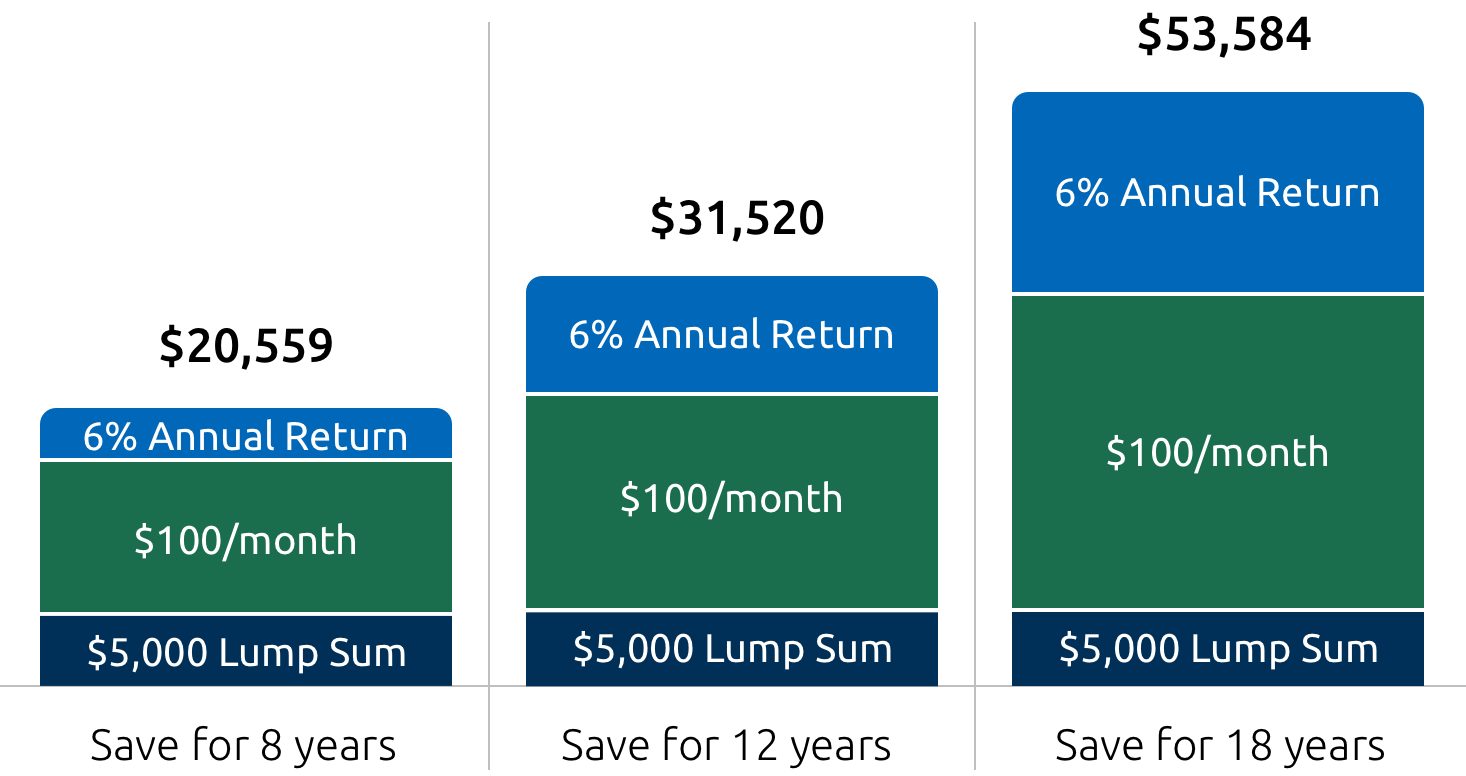

Source: districtcapitalmanagement.com

Source: districtcapitalmanagement.com

The Complete Guide To Virginia 529 Plans For 2024, 529 plans for each state have their own contribution limits.

Source: ardythylonnie.pages.dev

Source: ardythylonnie.pages.dev

529 Plan Maximum Contribution 2024 Pdf Download Pearl Brittany, In 2024, the annual 529 plan contribution limit rises to $18,000 per contributor.

Source: capstoneinvest.com

Source: capstoneinvest.com

2024 Retirement Plan Updates from IRS Financial AdvisorRetirement, This limit is subject to the annual roth ira contribution limit, which is $7,000 in 2024.

Source: vickiqtiffany.pages.dev

Source: vickiqtiffany.pages.dev

Max 529 Contribution 2024 Allyn Lorilee, Using your 529 savings account;

Source: www.scholarshare529.com

Source: www.scholarshare529.com

How Does A 529 Plan Work In California?, States generally set the contribution limit for their 529 accounts, rather than the irs setting the limit, as is the case with retirement accounts.

Posted in 2024